The deadline for e-filing your income tax form is on 15 May 2022 but before that make sure you claim these tax reliefs and possibly get back some money. This tax relief is allowed for childcare fees for a child aged 6 years and below paid to a registered child care centre or kindergarten.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

For YA2021 you are allowed to claim up to RM5000 in tax relief under this category.

. It clarifies that individual employee. As of the assessment year of 2021. Subscription of broadband internet.

Purchase of personal computers and laptops including MacBooks continue to be tax. If you did so and hope income tax not come for audit else good luck. Your rental income would be subject to tax in Malaysia as it is a Malaysian sourced income.

Tax residents can do so on the ezHASiL. Time to claim money back from jibgor No FM now This year can claim 2500 for lifestyleQuestion to k tax experts1. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability.

Each unmarried child and under the age of 18 years old. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. Another popular tax relief that you can easily take advantage of is the lifestyle category.

Under the special lifestyle tax relief the IRB states that an individual can claim for the purchase of a personal computer smartphone or tablet for the use of self spouse or child. Yes part of lifestyle. I subscribe to Digi Infinite 150.

In the new Permai stimulus package announced today the government has extended the special tax relief of RM2500 on purchases of phones computers and tablets to. Theres good and bad news for gadget geeks. 1 The types of breastfeeding equipment that are entitled to this income tax relief in Malaysia are the.

One of them is. The company even pays for my telephone bills and Internet subscription at home. The maximum tax relief amount.

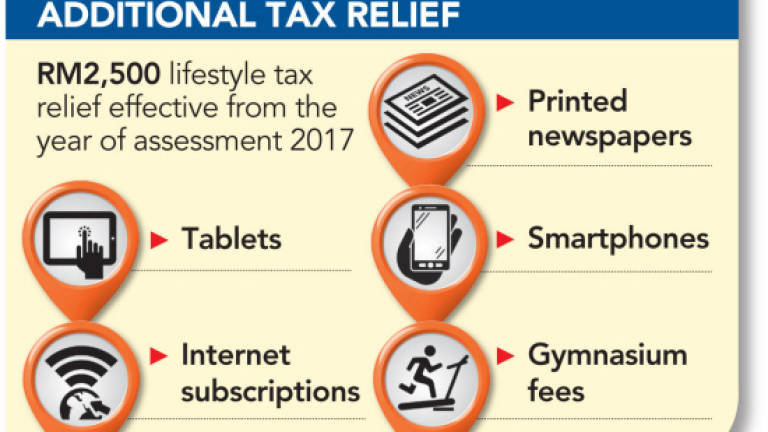

This is considered internet. The maximum claim for this relief is restricted. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills.

You can get up to RM2500 worth of tax relief for lifestyle expenses under this category. Those who have received. Tax season will be coming up soon for Malaysians making an income of at least RM34000 for the Year of Assessment YA 2021.

It is a combination of the tax relief for reading materials up to RM1000 a year computer up to RM3000 every three years and sports equipment up to RM300 a year. Also known as lifestyle tax relief in Malaysia this is the single persons favourite category under the topic of Personal Tax Reliefs. 2 Your new iPad.

Medical treatment special needs and carer expenses for parents Medical condition certified by a usebenefit medical practitioner. However you can claim the same relief if you buy a new smartphone computer or tablet in the year. Malaysia Inland Revenue Board IRB on 12 April 2011 issued a Technical Guideline on personal tax relief or deduction on the broadband subscription fee.

Special relief in addition to lifestyle relief for purchase of mobile phone personal computer or tablets for YA 2020 and YA 2021. Here are some of the more common reliefs that you likely dont wanna miss out. Husband and wife thingy also can claim.

Its tax season again for Malaysians earning over RM34000 for the Year of Assessment YA 2020. There are actually two amounts you can claim for your parents. Guys check with Maxis mobile data internet plan subscription is not claimable under income tax relief.

The lifestyle relief is for home Internet monthly bill subscription only. 28 rows books journals magazines printed newspapers. RM4000 for husband wife alimony payment to ex wife RM5000 for diabled.

Internet subscription paid through monthly bill registered under your own name. January 5 2022.

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Claims For Income Tax Relief Malaysia 2022 Ya 2021 Funding Societies My

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Malaysia Personal Income Tax Relief 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Pm Announces 4 Additional Tax Reliefs Including Newspaper Subscriptions For Budget 2017

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Lhdn Irb Personal Income Tax Relief 2020

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020